nso stock option tax calculator

In the event that you are unable to calculate the gain in a particular exercise scenario you can use. A non-qualified stock option NSO is a type of stock option used by employers to compensate and incentivize employees.

Nso Or Non Qualified Stock Option Taxation Eqvista

On this page is a non-qualified stock option or NSO calculator.

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

. The overall value of the NSO minus the amount paid for exercising the. Ad Investments Include Mutual Funds College Savings Plans Personalized Portfolios More. Ad Learn why over 370K members have invested over 25 billion with Yieldstreet.

Ad Fidelity Has the Tools Education Experience To Enhance Your Business. Youve made a 81 net gain on your NSO 150 52 sale tax. ISOs are attractive due to their preferential tax.

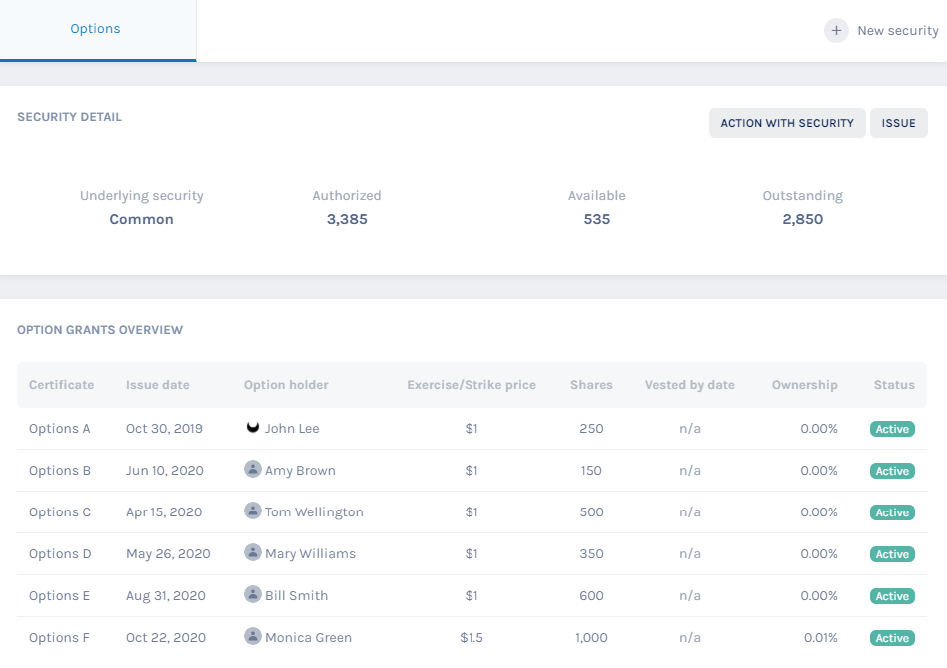

Your Equity Administration Deserves Industry-Leading Strategies from Fidelity. NSO Tax Occasion 1 - At Exercise. The Stock Option Plan specifies the total number of shares in the option pool.

Social Security tax 60000 x 62 3720. Add these three for a total of 19590. A non qualified stock option allows employees to buy shares of the companys stock for a predetermined rate.

This permalink creates a unique url for this online calculator with your saved information. Keep Your Finger on All Your Investments at All Time With Real Time Alerts on Your Options. This calculator illustrates the tax benefits of exercising your stock options before IPO.

Please enter your option information below to see your potential savings. The Stock Option Plan specifies the employees or class of employees eligible to receive options. NA not sold yet Number of shares.

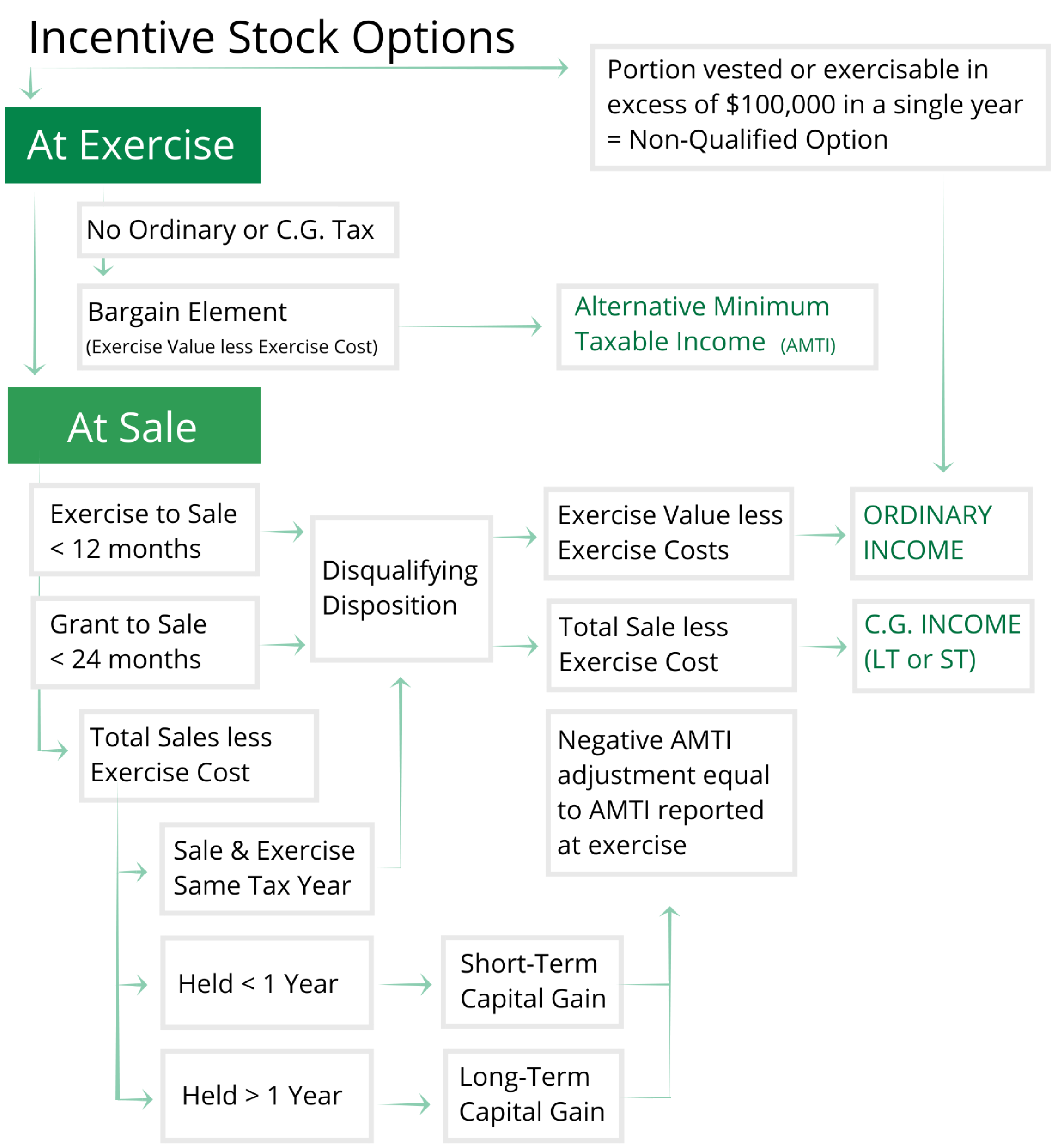

The tool will estimate how much tax youll pay plus your total return on your. On this page is an Incentive Stock Options or ISO calculator. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Cost of paying the taxes 19590 80 245 shares rounded up Add these two to obtain the total number of. The calculator is very useful in evaluating the tax implications of a NSO.

Ad Fidelity Has the Tools Education Experience To Enhance Your Business. Many companies try to estimate the right amount but it isnt very. January 29 2022.

Ordinary income tax and capital gains tax. Connect With A Prudential Financial Professional Via Video Phone Or In Person. How much are your stock options worth.

A non-qualified stock option NSO is a type of employee stock option where you pay ordinary income tax on the difference between the. There are two types of taxes you need to keep in mind when exercising options. A non-qualified stock option NSO is a form of equity compensation that can be provided to employees and other stakeholders.

Medicare tax 60000 x 145 870. Non-Qualified Stock Option - NSO. The minimum NSO exercise withholding requirement is only 22 for up to 1 million in spread value 37 if over 1 million.

The calculator is very useful in evaluating the tax implications of a NSO. Your Equity Administration Deserves Industry-Leading Strategies from Fidelity. This explains why employee stock options are a type of deferred compensation used to motivate and retain employees.

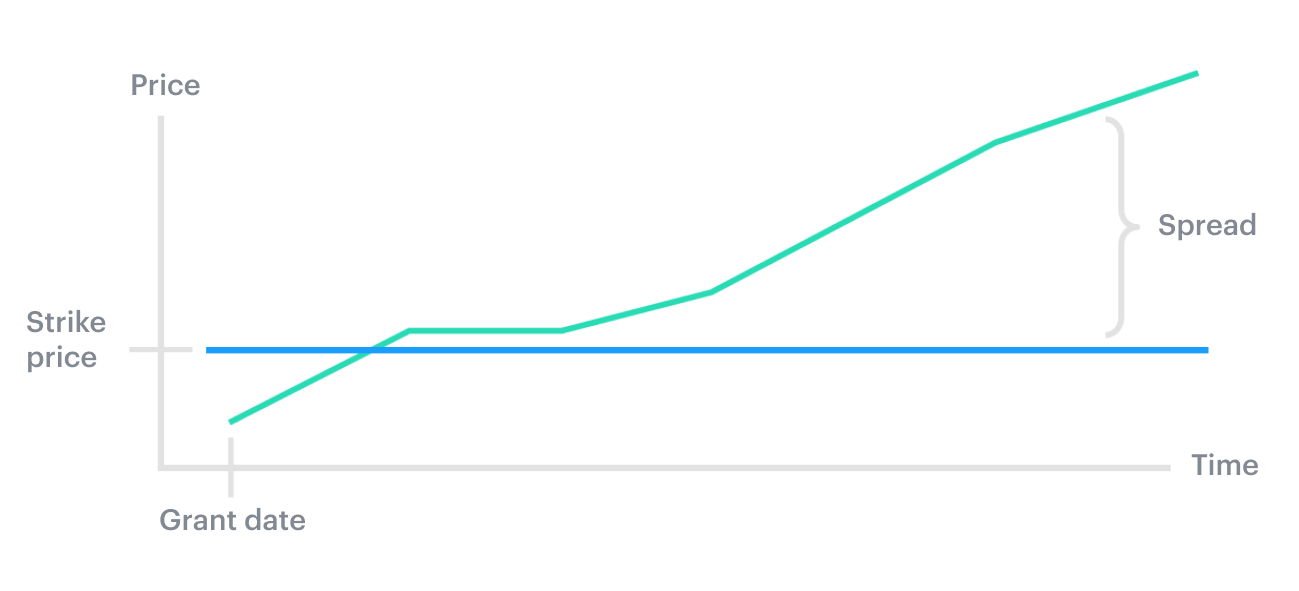

Diversify your portfolio by investing in art real estate legal and more asset classes. Your compensation element is the difference between the exercise price 25 and the market price 45 on the day you. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant.

On this page is a non-qualified stock option or NSO calculator. An NSO gives recipients the choice to. The provided information does not constitute financial tax or legal advice There is a simple way to understand the tax treatment on.

Click to follow the link and save it to your Favorites so. Calculate the costs to exercise your stock options - including taxes. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a.

In our continuing example your theoretical gain is. Federal tax 60000 x 25 15000. Stock Option Tax Calculator.

It is also a type of stock-based compensation. Ad Get Real Time Alerts on Any Active Put or Call Options Quickly Review Spreads. The tool will estimate how much tax youll pay plus your total return on your non.

When Should You Exercise Your Nonqualified Stock Options

Stock Options For Startups Founders Board Members Isos Vs Nsos

Nonqualified Stock Option Nso Tax Treatment And Scenarios Equity Ftw

How Stock Options Are Taxed Carta

Tax Planning For Stock Options

How Stock Options Are Taxed Carta

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

What Are Non Qualified Stock Options Nsos Carta

Should I Take An Nso Extension

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software

When Should You Exercise Your Nonqualified Stock Options

Non Qualified Stock Options Nsos

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

Stock Options For Startups Founders Board Members Isos Vs Nsos